Healthcare Gov Upload Documents Not Working Planning on Working

Turning 65 soon? You take a lot to consider earlier signing upwardly for Medicare, but at that place's no reason to be intimidated. Information technology's truthful that the process isn't as simple as but activating a simple one-size-fits-all insurance program anymore, but it'southward a process you lot can navigate with conviction if you lot take time to learn the details in advance.

For starters, Original Medicare coverage still exists, but seniors no longer take to settle for the limitations embedded in that erstwhile-school coverage. These days, Medicare supplements are a dominating strength — and a valuable lifeline — in the world of senior healthcare. Supplemental insurance plans take traditional coverage to the next level by filling in the coverage gaps that in one case toll patients thousands of dollars a yr. Here's a look at what you need to know to choose the right Medicare supplement for your personal situation.

Medicare Supplement Basics

Also known as "Medigap," Medicare supplement insurance plans are specifically designed to help cover some of the costs of services non covered past traditional Medicare Part A and Part B plans. Qualifying "gap" expenses include copayments, coinsurance amounts and deductibles.

Medicare supplements work in tandem with your Medicare policy. When a provider or infirmary sends a bill to Medicare, the plan pays its required share of the nib first. Your Medicare supplement then pays whatsoever of the remaining charges that authorize for coverage. For this to happen, you must accept Medicare Function A and Part B and pay the split monthly premium for the supplemental policy.

Medicare Supplements vs. Medicare Advantage Plans

Both Medicare supplements and Medicare Advantage plans provide coverage to fill up in the gaps left by traditional Medicare coverage, but they piece of work a footling differently. Y'all tin can't have both types of coverage, according to the official Medicare website, so it's of import to empathise all the differences before choosing.

In the simplest terms, Medicare supplement plans work in conjunction with your Medicare Part A and Part B coverage, while Medicare Reward plans work equally an alternative to Original Medicare. If y'all enroll in Medicare Advantage, you go your coverage benefits through that private insurer'south program instead of through the federal authorities's traditional insurance plan.

Medicare Advantage offers the same levels of Medicare Office A and Function B coverage, simply information technology normally includes prescription drug coverage — known every bit Medicare Function D — equally well. Many Medicare Advantage plans also come up with extras like dental, vision and hearing coverage along with wellness benefits like nutrition counseling and gym memberships.

Every bit the proper name suggests, Medicare supplemental plans merely supplement the coverages you already have. When you enroll in a Medicare supplement, you proceed your Original Medicare coverage, and it will serve every bit the master insurance for paying your healthcare bills, with the supplement picking up the tab for extra costs that authorize for the program.

Characteristics of Medicare Supplements

Medicare supplements are available through whatsoever licensed insurance visitor that has been approved past Medicare, but the exact companies that are bachelor to you will vary from country to state. It's also important to note that any standard supplemental policy comes with a guarantee for renewal, even if you already have or later develop potentially costly health weather. As long as y'all pay your monthly premiums, yous will continue to have your supplemental coverage.

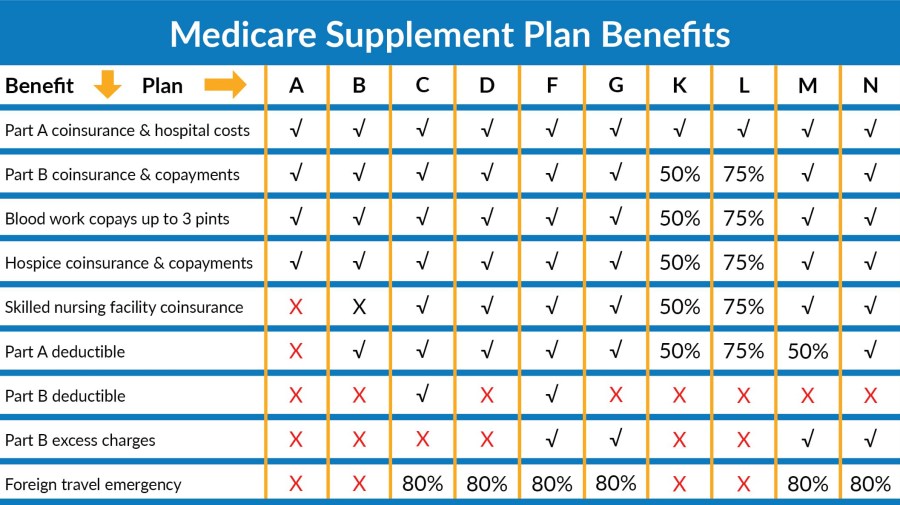

You volition have numerous program options to choose from, no matter which state you lot live in, and different plans will come with different coverage options. Before choosing a program, y'all should make up one's mind which benefits are most important for your personal circumstances. For example, if you have chronic health weather that frequently require expensive care, such every bit hospitalization, then finding a program with the highest percentage of coinsurance payments for Medicare Part A and Part B may exist your top priority.

If paying your monthly Medicare premiums already stretches your upkeep, then you may find it challenging to cover the price of even the simplest medical expenses, such equally doctors' visits. If that'south the example, so you may want a supplement that pays the cost of charges that are used to meet your deductible — charges that you would otherwise have to pay out of pocket yourself.

In some very rare cases, Original Medicare covers emergency medical expenses incurred in a foreign country, only these costs are far more than probable to exist covered past a Medicare supplement. However, specific rules utilise to unlike coverage plans. If you frequently travel outside the U.S., y'all might want to consider choosing a Medigap supplement that provides medical coverage for emergencies that occur during travel to foreign countries.

Practise I Need a Medicare Supplement?

It'southward not necessary for everyone to sign up for a Medicare supplement, merely if you accept reason to be concerned near the level of financial responsibility you could be left with afterwards an illness or accident occurs while you're on Original Medicare, yous may desire to seriously consider your options. These plans are specifically designed to help those who frequently use medical services salvage coin by paying much less out of pocket.

On the other manus, if you don't accept whatsoever known health bug and you have rarely needed or used your medical benefits throughout your life, you may feel the toll of a Medicare supplement plan outweighs the benefits. The alternative option of choosing Medicare Advantage instead of the Original Medicare/Medicare Supplement combo is also appealing to many seniors.

Medicare Supplement Coverage Limitations

While Medicare supplement insurance does provide extra benefits to patients, these policies still don't encompass everything. For example, they don't commonly provide benefits for eyeglasses and vision care, hearing aids, dental intendance, private-duty nursing or long-term care. Medicare Role C and Part F are the simply supplements that tin exist used to cover the Office B deductible, but new Medicare recipients who qualify after January 1, 2020, are not eligible to purchase plans that encompass Part B deductibles, so those supplements volition eventually phase out.

Insurance requirements and rules are always bailiwick to change. Be certain to read all the benefits offered by each Medicare supplement to choose the one that best meets your needs.

Resource Links:

https://world wide web.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap

https://www.medicare.gov/sign-up-change-plans/types-of-medicare-health-plans/medicare-advantage-plans/how-do-medicare-reward-plans-piece of work

https://www.medicare.gov/what-medicare-covers/what-medicare-wellness-plans-encompass/medicare-advantage-plans-embrace-all-medicare-services

https://www.medicare.gov/supplements-other-insurance/medigap-travel

https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies

santistevanfitain.blogspot.com

Source: https://www.symptomfind.com/healthy-living/how-medicare-supplement-plans-work?utm_content=params%3Ao%3D740013%26ad%3DdirN%26qo%3DserpIndex

0 Response to "Healthcare Gov Upload Documents Not Working Planning on Working"

Post a Comment